Here’s something that will shock precisely nobody: Flood insurance is a must-have for homeowners that live in an actual flood zone. But when a major storm comes to town, even those who aren’t technically in a flood zone might find themselves grateful for flood insurance.

First, let’s get a basic point out of the way: Flood zones are areas that are likely to suffer from an overflow of water during a storm. Homeowners in flood zones usually must obtain a flood insurance policy to get a mortgage, and borrowers with federally secured mortgage loans must acquire flood insurance for the life of the loan if they live in a flood zone, according to FloodSmart.gov. Homeowners who have paid off their mortgages are not required to get flood insurance.

“For many homeowners, flood insurance isn’t an option — it’s required,” said Steve Mostyn, founder of Mostyn Law, a Houston-based law firm. “However, even homeowners who aren’t obligated to carry it should still evaluate their risk. Even a minimal amount of flooding can have serious financial consequences.”

In fact, just a few inches of floodwater can lead to thousands of dollars in damage, according to FloodSmart.gov. That’s why United Policyholders, a consumer advocacy group, recommends that anyone who lives within a mile or two of a lake, river, or other body of water should have flood insurance.

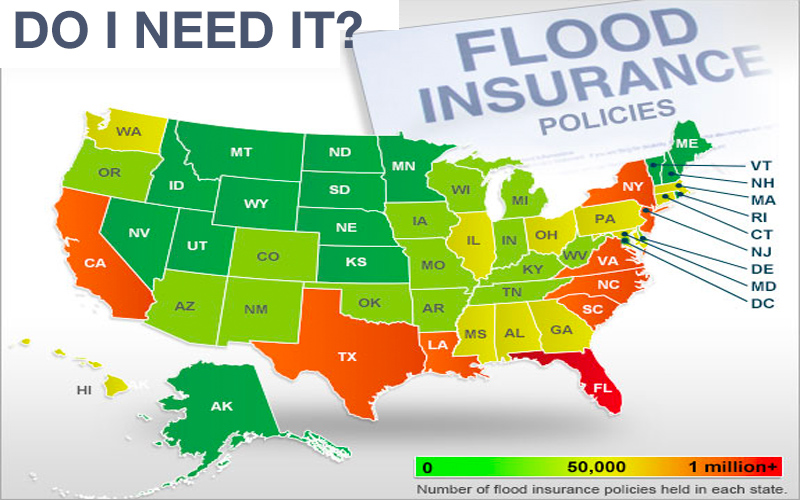

Unexpected floods can affect rivers, streams, creeks, canals, inlets and lakes. More than 20 percent of National Flood Insurance Program claims originate from people outside of mapped high-risk flood areas.

“People think, ‘I’m not by a river or stream, so I don’t need it,'” Keith Brown, chief executive of Kalispell, Mont.-based National Flood Services, a provider of flood insurance policies, told Consumer Reports. “But flooding can be caused by other things such as high snowpack, overdevelopment, or a storm drain backing up in a cul-de-sac.”

Flood insurance can also cover you in more unusual situations: for example, if your home floods from a mishap with a neighbor’s above-ground pool or a water main break down the block.

In flood zones, the U.S. government offers flood insurance through the National Flood Insurance Program (NFIP), a nationwide network of insurers that grants policies to property owners, renters and business owners. Outside flood zones, private policies are available.

Whether you’re inside a flood zone or not, flood insurance is usually not included in homeowner’s insurance, though some insurers offer it as an optional rider. That’s important to remember, because people often assume their property coverage accounts for flood damage and end up paying for losses out of their own pockets.

Residential flood insurance policies cover personal items such as food and clothing, as well as other structures, such as air conditioning units and furnaces. The average cost for flood insurance is $600 per year, and federal flood insurance policies are capped at $250,000, Chris Hackett, director of personal lines for the Property Casualty Insurers Association of America, told Bankrate.com.

If you purchase flood insurance, activate it well before the start of hurricane season, as there is a 30-day waiting period before the policy becomes active. You don’t want to be caught in a flooded home without insurance when the next hurricane hits.