“The insurance company took depreciation out of my claim check!” Occasionally someone will come to our office with this complaint about their insurance company. They often believe that they will never receive the depreciation payment. Yet, their claim documents show a depreciation payment will be sent to them after their repairs are complete.

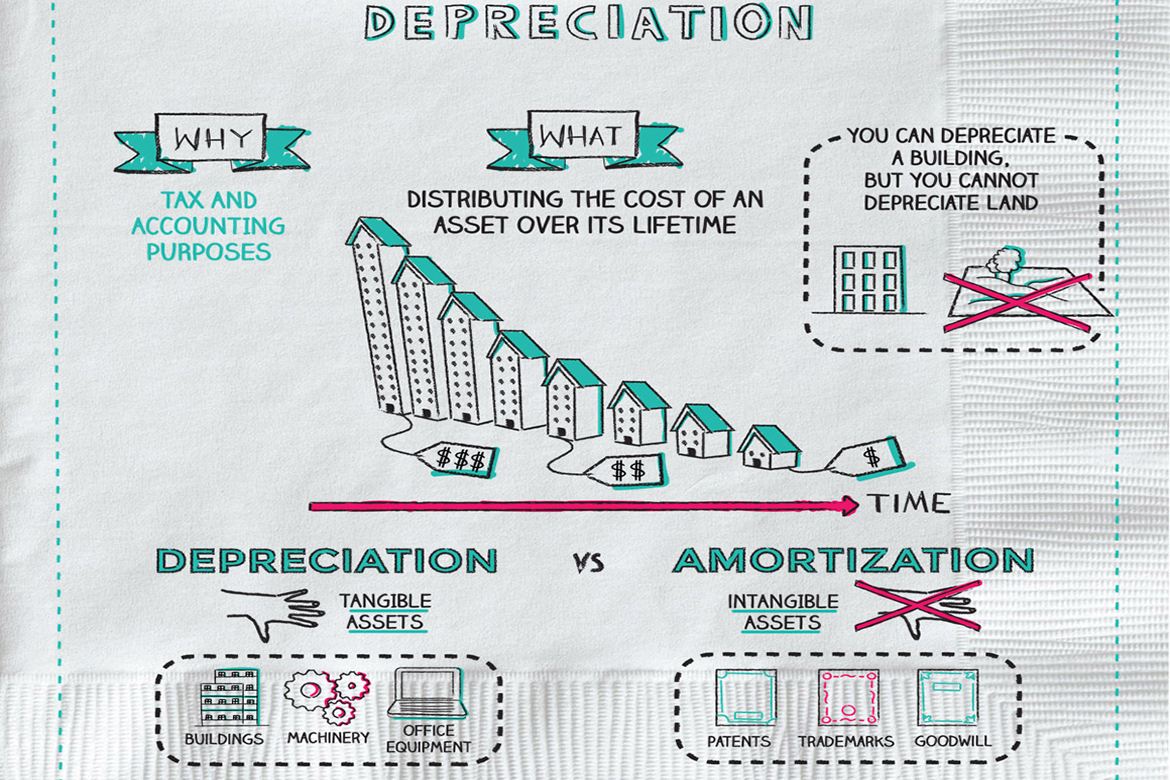

What is depreciation? Depreciation is the decrease in value related to age and wear and tear. If you have a replacement cost value policy, it will pay for the cost of replacing a damaged item, however, most of those policies require the damaged item to be repaired or replaced first before the depreciation is paid. If you have an actual cash value policy, it will only pay for the depreciated value of the damaged item and you won’t receive depreciation back once you complete repairs.

Your insurer may require you to submit receipts or paid invoices to show the repairs were completed before the insurer will disburse a check for depreciation. Other insurance companies may have a different requirement. Keep in mind, you may be given a limited amount of time to complete the repairs if you want to receive the payment for deprecation. Most insurance policies provide a deadline of one year to recover depreciation. If you think you will need more time, request an extension in writing from your insurance company. There is no guarantee they will grant the extension but it is a possibility.

Call your agent or insurance company if you have questions about depreciation or just if you have a general question about your policy. Many insureds are not clear on what their policy covers. The worst time to discover that information is after a claim is filed. Also, it’s best to review your policy coverage at least once a year to make sure no changes are necessary. If your home was damaged, you would want your policy to pay for the cost of replacing or repairing what was damaged, not actual cash value. Your home is one of your most valued assets and you will be serve you best to have a policy that covers it adequately.